Abstract

Bangladesh is the nineteenth largest natural gas producer in Asia. In Bangladesh, natural gas was discovered in a belt stretching from the country's northeast and east to the southeast and southern parts. Sangu is Bangladesh's first and only offshore gas-field, although shut down recently. Besides, mineral oil was discovered at Haripur in Sylhet - the oil field's present output is insufficient. Evidently, Bangladesh is lagging far behind other countries in exploration of oil and gas since the petroleum sector failed to reach an expected level of success in the country's overall development. Offshore drilling in Bangladesh is almost nonexistent and the exploration data is not sufficient to analyze the country's oil and gas reserve. However, from the deltaic nature, depositional history and sediment criterion, it seems that deep offshore and adjacent areas might be rich in oil and gas. Bangladesh is spending huge foreign currency on importing crude oil and hence drawing back in terms of a sustainable development. The time has come to focus on petroleum exploration in the vast offshore areas in pursuit of 'black gold'. This report focuses on the offshore nature and structures of Bangladesh.

1. Introduction

Offshore structures have special economic and technical

characteristics. Economically, offshore structures are dependent on oil and gas

production, which is directly related to global investment, which is in turn

affected by the price of oil. For example, in 2008 oil prices increased

worldwide, and as a result many offshore structure projects were started during

that time period.

Bangladesh has small reserves of oil and coal, but potentially very

large natural gas resources. The northeastern Sylhet Division is

the country’s largest natural gas and crude oil producer, followed

by Chittagong Division, Dhaka Division and Barisal

Division. While dozens of offshore blocks lay in the Bay of Bengal.

Natural gas from Bangladesh is renowned for being very pure with a composition

of 95–99% methane and almost no Sulphur content. [1] The Arbitral Tribunal in

The Hague, dealing with the Bay of Bengal Maritime boundary Arbitration between

Bangladesh and India awarded 19,467 sq-km maritime area to Bangladesh out of

disputed 25,602 sq-km area. [2] So there are huge possibilities in the offshore

sector in Bangladesh.

In this report, the condition of offshore structures of Bangladesh will

be discussed. Which includes existing offshore structures, offshore blocks,

their location and corresponding water depth, suitability of particular

offshore structures and opportunities for offshore renewable energy in

Bangladesh.

2. Background

The history of hydrocarbon exploration of Bangladesh dates back to

1910 when Indian Petroleum Prospecting Company (IPPC) and Burmah Oil Company

(BOC) drilled four exploration wells in the Sitakund anticline, north of

Chittagong in SE Bangladesh. In 1933, BOC drilled two wells in the Sylhet area

near Patharia in the far NE. Except for minor, non-commercial oil and gas shows,

no significant discoveries were made. During the second phase (1951-1970),

several multinational oil companies including Shell Oil Co. conducted

exploration activities in Bangladesh. Of 22 exploration wells drilled during

this period, eight wells were reported to flow commercial quantities of gas.

Five major gasfields (Rashidpur, Kailashtila, Titas, Bakhrabad and Habiganj,)

were discovered during this period; all are located in the northern part of the

Eastern Fold Belt. A third phase (1971-1990) of hydrocarbon exploration started

immediately after the emergence of Bangladesh as a sovereign nation in 1971.

During 1974-78, six multinational companies including ARCO, Ashland and Union

Oil Co. signed Production Sharing Contracts with Petrobangla (the national oil

company) to explore offshore areas, and seven wells were drilled in the Bay of

Bengal. This resulted in the discovery of the offshore Kutubdia gasfield.

By 1980, the foreign oil companies pulled out of Bangladesh leaving Petrobangla

as the sole operator in the country. In 1986, Petrobangla discovered Haripur,

the first and only oilfield so far discovered in the country. Of the 23

exploration wells drilled during this phase, eight gasfields were discovered.

Exploration picked up momentum again during the 1990s (the fourth phase) when

another group of multinational companies (Occidental/Unocal, Cairn

Energy/Shell, Oakland/Redwood, Tullow/Chevron, and United Meridian) signed

exploration leases with the Government in both onshore and offshore. During

1991-2000, Petrobangla and the multinationals drilled a total of 13 exploration

wells and five gasfields were discovered. [5]

Cairn and HSSB acquired seismic data over a large

part of Block 16 in early 1995 and subsequent interpretation of this data

identified a number of significant prospects. In December 1995, the group began

drilling the Sangu-1 exploration well on a prospect approximately half way

between the Kutubdia gas discovery and the port of Chittagong. This well

discovered gas in January 1996 in a number of gas-bearing zones. Two of the

zones were tested at a combined stabilized cumulative rate 82 MMcf/d, the

highest flow rate ever recorded from a single well in Bangladesh. The well has

been suspended as potential future producer.

Following

the success of the Sangu-1 well, the Sangu-2 well was drilled approximately

five km northwest of Sangu-1. The Sangu-2 well encountered gas in the main zone

tested in the Sangu-1 well. In addition, deeper potential pay was encountered

and the selection has not yet been fully penetrated. Sangu-2 was suspended and

the exploration rig was moved off the location prior to the start of the monsoon

season. The results of the two wells confirmed the potential for a commercial

development and the group began plans to appraise and develop the Sangu Field.

This began with an infill seismic survey in July-August 1996. The development

plan calls for gas to be produced from a central production platform and

transported by a 45 km pipeline to the Chittagong area for connection into the

national gas pipeline grid. Under the terms of the block 16 PSC and the

recently negotiated and signed GPSA, Petrobangla will be the sole purchaser of

the gas.

In May

1995, Cairn signed a memorandum of understanding (MOU) with a British company

Midlands Power International Limited (MPI) whereby, pending approval from

Petrobangla and the GOB, MPI has acquired a 30% interest in a sub-area of block

15 including the Semutang gas field. MPI has in its own right a MOU with the

Ministry of Energy and Mineral Resources of the GOB for power generation

projects in the private sector. Cairn exercised its option to participate in a downstream

integrated power project planned for the Dhaka area in November 1995. The power

project, named the "Tiger Power Project", could be fueled by gas

either from Semutang gas field or from any other gas discoveries that a group

elects to develop.[3]

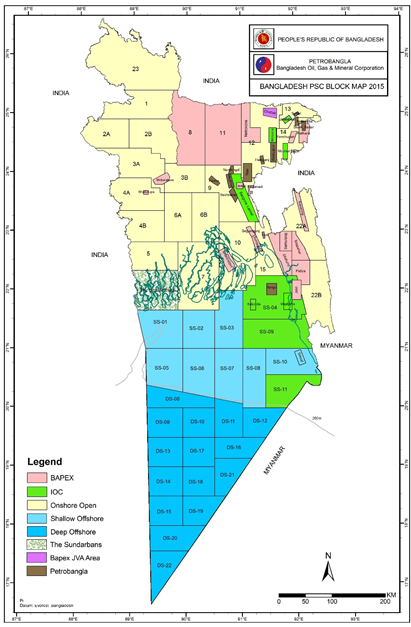

3. Offshore Blocks of

Bangladesh

Bangladesh’s full access to high seas out to

200 NM and beyond is now guaranteed as are Bangladesh’s undisputed rights to

fishing in waters and the natural resources beneath seabed. Bangladesh

currently has 26 blocks in the Bay. Of them 15 are deep-sea blocks and 11 are

in shallow waters. The previous victory for Bangladesh came on 14 March 2012

when the International Tribunal for the Law of the Sea (ITLOS) in Homburg

delivered the judgment in the maritime boundary case with Myanmar. Bangladesh

now hopes to invite international bidding this year to explore for gas in the

maritime areas it gained after resolution of dispute with India. Bangladesh

will try to conduct exploration through its own resources in some shallow water

blocks. The deep-water blocks may be placed for the international bidding. With

the newly acquired sea area, our sea resources have increased and the sea

resources potential has to be exploited. For this we have to develop our

skilled manpower for exploration of oil and other natural resources as well as

fishing on the high seas. Offshore block bidding with International Companies

who will explore for oil and also exploration for offshore blocks by Bangladesh

will need trained manpower which has to be developed. We look forward a

prosperous era for Bangladesh and a peaceful exploitation of our sea resources

in a friendly atmosphere with India.

The Production Sharing Contracts (PSC’s) of

the Blocks SS-04 and SS-09 were signed by Government of People’s Republic of

Bangladesh, Bangladesh Oil, Gas & Mineral Corporation (PETROBANGLA),

consortium ONGC Videsh Limited (OVL) & OIL India Limited (OIL) and

Bangladesh Petroleum Exploration and Production Company Limited (BAPEX) on 17

February, 2014. OVL will act as the Operator of these two Blocks with Participating

Interest of 45%, OIL holds 45% PI and BAPEX 10%.

The Block SS-04 covers an area of 7,269 sq.

km with water depths ranging from 20-200 m and the Block SS-09 covers an area

of 7,026 sq. km with water depths ranging from 20-200 m. The exploration term

for the both blocks consists of 8 (eight) consecutive contract years comprising

5 (five) years as Initial Exploration Period and 3 (three) years as Subsequent

Exploration Period. As per PSC, ONGC Videsh Limited will conduct 2700

Full Fold LKM 2D Seismic Data Acquisition and Processing & 1 exploratory

well in Block SS-04 and 2700 LKM 2D Seismic Data Acquisition and Processing

& 2 exploratory wells in Block SS-09. Now Exploration Phase I is in

progress for both Blocks.

As of end of March 2016, ONGC Videsh Limited

conducted total 3008.130 Full Fold LKM 2D Seismic Data Acquisition for the both

Blocks SS-04 and SS-09. The rest of the seismic volume will be 2D OBC Survey

& Land Seismic Survey and will be conducted within Initial Exploration

Period. [2]

3.1 Hydrocarbon Exploration

Tender

On December 9 2012 the government

announced the 2012 offshore oil-and-gas-exploration tender inviting offers from

the international companies for exploring hydrocarbons in 12 blocks in the Bay

of Bengal. The tender due was March 18 2013. Awards are expected by mid-2013.

The tender comprises nine shallow sea-blocks and three deep water blocks.[4]

Table – 1:

Offshore blocks [4]

|

Block Type |

Blocks |

Location |

Area |

Water Depth |

|

Shallow Blocks |

SS – 01 SS – 02 SS – 03 SS – 04 SS – 05 SS – 06 SS – 07 SS – 08 SS – 09 SS – 10 SS – 11 |

Bay of Bengal |

Each have exploration area between 4,500 and 7,700

sq. km |

Between 20 – 200 metres |

|

Deep-Sea Blocks |

DS – 12 DS – 16 DS – 21 |

Bay of Bengal |

Each have exploration area between 3,200 and 3,500

sq.km |

Between 200 – 2000 metres |

|

DS – 19 |

11170 sq. km |

|||

|

DS – 20 |

12153 sq. km |

|||

|

DS – 21 |

12454 sq. km |

NB: The

location of other blocks are shown in fig -1.

4.

Offshore Structures of Bangladesh

4.1

Kutubdia LNG Terminal (Proposed)

Kutubdia

Island has a natural harbour with a good draft and a natural breakwater that's

ideal for setting up a LNG terminal. The proposed terminal is beside

Bangladesh's proposed Matarbari LNG Terminal in Moheshkhali Island of the Cox's Bazar district of

Anwara, Chittagong. The Kutubdia LNG terminal, to be set up on the

build-own-operate basis, will supply gas to power plants. Kutubdia LNG

includes proposals to import gas by barge and truck to off-grid customers in

Bangladesh.

In December 2016, Bangladesh

government-owned Petrobangla signed an initial agreement with India government-owned

Petronet to set up an LNG regasification terminal on Kutubdia Island and a

pipeline. The estimated cost is US$950 million. During

Petrobangla's FY 2017-2018, a feasibility study related to the terminal's installation

was completed.

In February 2019 Petronet

announced that it was delaying development of the project, which now appears to

be shelved.

4.2 Kutubdia Gas Field

The Kutubdia gas field is located in the Bay of Bengal, Cox's Bazar

District in the Division of Chittagong, in Bangladesh. The field is estimated

to have recoverable gas reserves of around 45.50 billion cubic feet (Bcf), but

an inadequate gas demand at the time might have prompted the now-defunct Union

Oil to leave the field undeveloped. Santos had recently sought exploration

rights on Kutubdia. It subsequently abandoned plans to drill in the offshore

Magnama structure in the Bay of Bengal over October 2012-April 2013 as it has

not received rights to explore the nearby Kutubdia gas field. Santos first

acquired rights to the field in 2010 when it acquired Cairn Energy's interests

- including block 16 - in Bangladesh in November 2010, but it later

relinquished its rights to the field. The Australian firm was eyeing to develop

the Kutubdia field along with its planned drilling programme in offshore

Magnama in 2013.

4.3 Sangu Gas Field

Sangu Gas Field is a natural gas

field in Bangladesh. It is the only offshore gas field in Bangladesh

that is currently abandoned. This gas field was discovered in 1996 in

the Bay of Bengal 50km away from the land near

Silimpur, Chittagong. Santos,

an Australian multinational company was in charge of operation of the

gas field. Its production was closed in 2014. To store the imported LNG,

the government of Bangladesh is planning to convert the offshore

gas field into an underground storage, where 487.91 billion cubic feet

of gas can be stored. Currently in Bangladesh, there are 22 onshore blocks and

26 offshore blocks. Among these offshore blocks, 11 are shallow blocks, where

the other 15 are deep sea blocks.

In 1998, British

oil company Cairn Energy started producing gas from Sangu Gas

Field. It initially produces about 50 million cubic feet of gas daily.

Later it increased up to 180 million cubic feet a day. Production levels

dropped to an average of 49 million daily in 2009, and 18 million cubic feet

per day on average in 2011. It was declared abandoned when gas

production dropped from two to three million cubic feet daily at the end of

the 2013. According to Petrobangla, about 488 billion cubic

feet of gas is produced from this gas field from 1998 to 2014.

Figure 2: Sangu Gas Field

Moheshkhali

LNG Terminal

Moheshkhali

floating liquefied natural gas (LNG) terminal is being developed offshore the

Moheshkhali Island in the Bay of Bengal, Bangladesh. It will be the country’s

first LNG import terminal and is expected to help secure the future provision

of energy in the country. The terminal will cost an estimated $179.5m and

feature a base-load capacity of 500 million standard cubic feet of gas a day

(MMscf/d). The project will be jointly developed by Excelerate Energy and

Petrobangla on a build, own and operate basis. Moheshkhali

Floating LNG provides much-needed clean energy to promote power reliability,

industrial development, and job creation in a sustainable manner. Excelerate

Energy developed and will operate the terminal for 15 years, after which

the company will transfer ownership to Petrobangla allowing for continued

realization of its benefits. Moheshkhali floating LNG terminal will include a

floating storage and regasification unit (FSRU), a subsea buoy system and a

subsea pipeline, which will connect the terminal to an onshore pipeline system.The

FSRU will have a storage capacity of 138,000m³ of LNG and a regasification

capacity of 500Mscf/d. The terminal’s offshore subsea buoy system

will be used for mooring and will also serve as a conduit to transfer natural

gas onshore. All the necessary geotechnical and geophysical studies for the

terminal’s construction have been completed and confirmed the site’s viability.

Figure 3: Moheshkhali

Floating LNG terminal (Source: Excelerate Energy)

4.5 Matarbari Deep Sea Port

Matarbari Port is an

under-construction deep sea port at Matarbari in Maheshkhali

Upazila of Cox's Bazar District, Bangladesh. At the first stage, one

300 meter long multipurpose terminal and one 460 meter long container

terminal will be constructed within 2026. The ports navigational channel will

be of 350 meter length with a draught of 16 meter where ships with

the capacity of 8,000 TEU containers will be able to dock. Later, the container terminal will be expanded, comprise 70 hectares,

have a 1,850-meter berth, and have a 2.8-million-tonne capacity. JICA said the

multi-purpose terminal will be built on 17 hectares, have a 300-meter berth,

and be able to accommodate vessels with up to 70,000 dwt. Its annual capacity

will be 2.25 million tonnes. Currently, vessels with less than a 9-meter draft

can call at the country’s two seaports at Chittagong and Mongla. The deep sea port’s multi-purpose terminal will be

ready for container shipping vessels by November 2022, and a coal terminal will

be constructed by August 2022.

5. Offshore Renewable

Energy

Despite

Bangladesh emerging relatively unscathed from the 2008/9 economic crisis, the

recent energy crisis has been a serious burden to the Bangladesh’s economy.

According to the world bank, the lack of a reliable supply of power and gas

remains a major constraint on business. While total gas production has

increased 7% between 2009 and 2011, gas sales to the power sector have declined

20.3%, as scarce gas is diverted to residential and CNG consumers. The ensuing

power shortage has caused disruption in industrial production, particularly in

the clothing, ceramics, fabrics and steel industries. Although large factories

have their own power generation kits, they also suffer due to gas shortage. The

world bank estimates that most industrial facilities in Bangladesh are

operating at half of their installed capacity due to a lack of reliable power

and gas. The annual loss of production and income from power outrages could

exceed 0.5% of GDP per year. Offshore renewable energy could be a solution for

this issue. [5]

Bangladesh has set a 3.17

GW of renewable energy goals for 2021, or about 12.5% of total domestic power

production. Offshore winds off the coast of Bay of Bengal holds the best source

of wind energy we can tap into to ensure a diversified portfolio of renewable

energy sources. The unique seabed structure of the Bay of Bengal can be used to

our advantage for anchoring offshore wind farms. The technology is mature

enough to be deployable with minimum risk in Bangladesh.

5.1 Wind Power

The long term wind flow,

especially in the islands and the southern coastal belt of Bangladesh indicate

that the average wind speed remains between 3 and 4.5 m/s for

the months of March to September and 1.7 to 2.3 for remaining period of the

year.[6] There is a good opportunity in island and coastal areas for the

application of wind mills for pumping and electrification. But during

the summer and monsoon seasons (March to October) there can be very low

pressure areas and storm wind speeds 200 to 300 km/h can be

expected. Wind turbines have to be strong enough to withstand these

high wind speeds. [7]

5.2 Tidal Power

The tides at Chittagong

Division are predominantly semidiurnal with a large variation in range corresponding

to the seasons, the maximum occurring during the south-west monsoon. In 1984,

an attempt was made by mechanical engineering department of KUET to

assess the feasibility of tidal energy in the coastal regions of

Bangladesh, especially at Cox's Bazar and at the islands

of Maheshkhali and Kutubdia. The average tidal

range was found within 4-5 meter and the amplitude of

the spring tide exceeds even 6 meters.[8] From different

calculations, it is anticipated that there are a number of suitable sites at

Cox's Bazar, Maheshkhali, Kutubdia and other places where permanent basins with

pumping arrangements might be constructed which would be a double operation

scheme.[9][10]

5.3 Wave Energy

Bangladesh has favorable

conditions for wave energy especially during the period beginning

from late March to early October. Waves generated in Bay of

Bengal and a result of the southwestern wind is significant.[11]

Maximum wave height of over 2 meters with an absolute maximum of 2.4

meter were recorded. The wave periods varied from 3 to 4 seconds for

waves of about 0.5 meter and about 6 seconds for waves of about 2 meters. [12]

6.

Offshore Exploration

In 1974 the

government awarded seven shallow water offshore blocks on the continental shelf of Bangladesh to six international oil

companies. However, these companies left Bangladesh in 1978 amid technical

difficulties and political

instability. Oil was

their primary target and early exploration indicated that the area possessed

gas rather than oil. The world petroleum scenario had since changed and

interest in gas exploration increased among IOCs, despite challenges in

offshore deep water exploration. In 1998, the Bangladeshi government

awarded four shallow water blocks for to a new group of IOCs. Shell, Cairn Energy and Santos operated

the offshore Sangu gas platform.

Since 2009,

the Bangladeshi government has launched bidding rounds for awarding deep water blocks. Conoco Philips and Tullow Oil won the

first round of bids. The victory of Bangladesh over Myanmar in securing

maritime territory in the Bay of Bengal has increased the number of exploratory

blocks in the EEZ to 27.

7. Offshore

Structure Suitability

7.1 Spectral Wave Characteristics Of Nearshore

waters of Northwestern Bay of Bengal

The spectral wave characteristics in the nearshore waters of northwestern Bay of Bengal are presented based on the buoy-measured data from February 2013 to December 2015 off Gopalpur at 15-m water depth. The mean seasonal significant wave height and mean wave period indicate that the occurrence of higher wave heights and wave periods is during the southwest monsoon period (June–September). 74% of the sea surface height variance in a year is a result of waves from 138 to 228° and 16% are from 48 to 138°. Strong inter-annual variability is observed in the monthly average wave parameters due to the occurrence of tropical cyclones. Due to the influence of the tropical cyclone Phailin, maximum significant wave height of 6.7 m is observed on 12 October 2013 and that due to tropical cyclone Hudhud whose track is 250 southwest of the study location is 5.84 m on 12 October 2014. Analysis revealed that a single tropical cyclone influenced the annual maximum significant wave height and not the annual average value which is almost same (~ 1 m) in 2014 and 2015. The waves in the northwestern Bay of Bengal are influenced by the southwest and northeast monsoons, southern ocean swells and cyclones. [13][14][15]

7.2 Suitability

Table – 2: Different Structures and

their required water depth

|

Structure |

Required Water

Depth |

|

Jacket |

Up to 150 m |

|

Jack-up |

Less than 150 metres |

|

Semi-submersible |

200m - 3000 m |

|

TLP |

300 – 1500 m |

|

GBS |

13.7 - 25.9 m |

|

Spar |

Presently used up to 1000 m,

although existing technology can extend upto 2500m. |

|

FPSO |

Up to 2600m |

From

the offshore blocks (section - 3.1), we can see Bay of Bengal has a water depth

in between 20 – 200 m in shallow sea blocks and in deep sea block she has a

water depth in between 200 – 2000m. However, we can see in case of water depth

any of the above structures are suitable. So, we have to consider the

individual water depth of every block. Due to lack of sufficient data I was

unable to conclude the suitability of offshore structure for a specific block.

8. Conclusion

Evidently, Bangladesh is lagging far behind other countries in exploration of oil and gas since the petroleum sector failed to reach an expected level of success in the country's overall development. Offshore drilling in Bangladesh is almost nonexistent and the exploration data is not sufficient to analyze the country's oil and gas reserve. However, from the deltaic nature, depositional history and sediment criterion, it seems that deep offshore and adjacent areas might be rich in oil and gas. Bangladesh is spending huge foreign currency on importing crude oil and hence drawing back in terms of a sustainable development. The time has come to focus on petroleum exploration in the vast offshore areas in pursuit of 'black gold'. Therefore, Bangladesh should focus more on building offshore structures for harnessing the offshore resources.

References

[1] Mahmood Alam, M.Mustafa Alam, Joseph

R. Curray, M. Lutfar Rahman Chowdhury, M. Royhan Gani

An overview of the sedimentary geology of the

Bengal Basin in relation to the regional tectonic framework and basin-fill

history

Sediment.

Geol., 155 (3–4) (2003), pp. 179-208

[2] Petrobangla - Bangladesh

Sea Block

[3] Offshore

Magazine Post, Published: April 1st, 1997

[4] Gomes,

Ieda. Natural Gas in Pakistan and Bangladesh–current issues and trends.

Oxford Institute for Energy Studies, 2013.

[5] Imam,

M. Badrul, and M. Hussain. "A review of hydrocarbon habitats in

Bangladesh." Journal of Petroleum Geology 25.1 (2002):

31-52.

[6] The Dhaka University Journal of Science, Volume 55. University of Dhaka. 2007. p. 53.

[7] CAJ

Paulson (2001). Greenhouse Gas Control Technologies: Proceedings of the

5th International Conference on Greenhouse Gas Control Technologies.

Csiro

[8] B. W.

Flemming; A. Bartoloma (2009). Tidal Signatures in Modern and Ancient

Sediments: (Special Publication 24 of the IAS) Volume 28 of International

Association Of Sedimentologists Series. John Wiley & Sons.

p. 329. ISBN 9781444304145.

[9] Tom Koppel

(2007). Ebb and Flow: Tides and Life on Our Once and Future Planet.

Dundurn. ISBN 9781459718388.

[10] "Harnessing

tidal power". The Daily Star. Retrieved 2014-08-23.

[11] "Wave-based

power plant takes shape in Bangladesh". The

Daily Star. Retrieved 2014-08-23.

[12] Mohammad

Aslam Uqaili; Khanji Harijan (2011). Energy, Environment and Sustainable

Development. Springer. p. 19. ISBN 9783709101094.

[13] Aarnes, O. J., Abdalla, S., Bidlot, J., & Breivik, O. (2015).

Marine wind and wave height trends at different ERA-interim forecast

ranges. J. Climate, 28, 819–837.

[14] Alam, M.,

Hossain, A., & Shafee, S. (2003). Frequency of Bay of Bengal cyclonic

storms and depressions crossing different coastal zones. International

Journal of Climatology, 23, 1119–1125.

[15] Amrutha, M. M., Sanil Kumar, V., & George, Jesbin. (2017). Observations of long-period waves in the nearshore waters of central west coast of India during the fall inter-monsoon period. Ocean Engineering, 131, 244–262.

Date of Publication: 03-11-2021