Case Statement:

We are planning on starting a new business of our choice, which may be a sole proprietorship or partnership. We are initially limited to £10,000 of financial resources and have no additional income, but we may be able to borrow funds from elsewhere. We have no time constraints, since we have completed our full-time studies, so can devote ourselves to the business on a full-time basis.

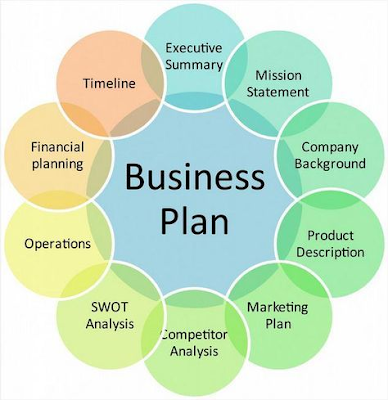

Our plan should contain all the elements of a business plan, including cash flow and profit forecasts, as shown below; we do not need to have appendices.

Solution

As I have studied accounting as my master's I believe I have potential to develop an accounting business and would name Accounting Plus solutions - it offers small- and medium-sized businesses services that reduce invoicing expenses, speed receipt of monies, and allow authorization and recovery of paper drafts. Accounting is an essential element of every business and business plan has wide client base.

Executive summary

Objectives

1. Total receivables of $40,000 in Year 1.

2. Monthly receivables of $4,000 by the sixth month of operation.

3. Minimum of 10% increase in receivables per month.

4. Receivables of $10,000 per month by the eighteenth month of operation.

Mission

Accounting Plus solutions, offers small- and medium-sized businesses access to services that increase available operating funds by automating accounts receivable for more timely payment, and allowing merchants to accept paper checks with confidence.

As a service company, we pledge to our customers:

1. Exceptional value for all services rendered.

2. Timely response to questions and concerns.

3. Total honesty and integrity.

Keys to Success

1. Direct, person-to-person marketing - Emphasising Professional services at best price.

2. Participation in professional business organizations.

3. Frequent follow-up and reselling the value of our service.

Market conditions

Our target market is comprised of service and retail businesses because of the nature of the services we provide.

We need to focus our marketing efforts at a local level, allowing growth in other areas to be a source of additional revenues that we will not be dependent on for success.

The service and retail industries have experienced strong growth historically; and consumer spending and confidence are at all-time highs and are continuing to grow.

The trend to outsource services is established for businesses and will see increases as finding employees to staff positions continues to become more difficult.

Management team

We are a small company, owned and operated by sole owner, we will need one bookkeeper and salesperson. I will be managing the marketing activities and other person will be responsible for bookkeeping. This way there will be segregation of duties basis core competencies.

Production and operations plan

For production we will be providing several services like Pre-authorized Checking, Electronic Payments, Electronic Check Recovery, e- commerce assistance.

The key fulfillment and delivery will be provided by the principals of the business. The real core value is the combination of hard work, attention to detail, and strong sense of service

Human resources plan

All the team members will be trained to understand business values and highest output services. Special training and instructions to sales personnel. Initially, we will start with fixed compensation package, once business flourishes we can introduce incentive plans to increase our sales.

Marketing plan

In many respects, competition is non-existent for our services. Small- and medium-sized businesses generally cannot utilize pre-authorized checks and electronic payments on their own. These options are mostly reserved for large organizations such as insurance companies and banks.

Pricing for these services is well below what most businesses spend to invoice customers, and these services have met with wide approval throughout the United States.

The most important element of general competition is what it takes to retain customers, as these services are highly price competitive. It is worth making great efforts to maintain personal relationships with our customer base so that we are able to make concessions where necessary to retain customers.

Financial plan

We will need 40,000 to finance our business, of which we currently have 10,000 - we can get 30,000 financed based on assumptions of a loan financed at 9.5% interest for a 3-year term.

The financial plan depends on carefully researched operating expenses. Actual cost was used in calculating these expenses.

It is important to note that the Projected Profit and loss does not reflect any cost of sales. These costs are included in our actual operating expenses. The main reason this is so is that many of the services we provide have virtually no direct cost, as they are paid to our company as commissions.

Future outlook

For future we assume it to be smooth business, in case there is increase in customer base - we can seek partnership in long run. In case of decline we can look for a partner that we can share resources with.

There are several business risks including financial and marketing risks that are to be addressed and as per industry norms will be addressed.

nice

ردحذفIt is what I was searching for is really informative.Online Bookkeeper Sydney It is a significant and useful article for us. Thankful to you for sharing an article like this.

ردحذف